In today’s fast-paced investment world, staying informed about market trends is more critical than ever. Understanding vast amounts of data quickly and making informed decisions can give investors the edge they need. One tool that has proven to be a game-changer is the market overview heat map.

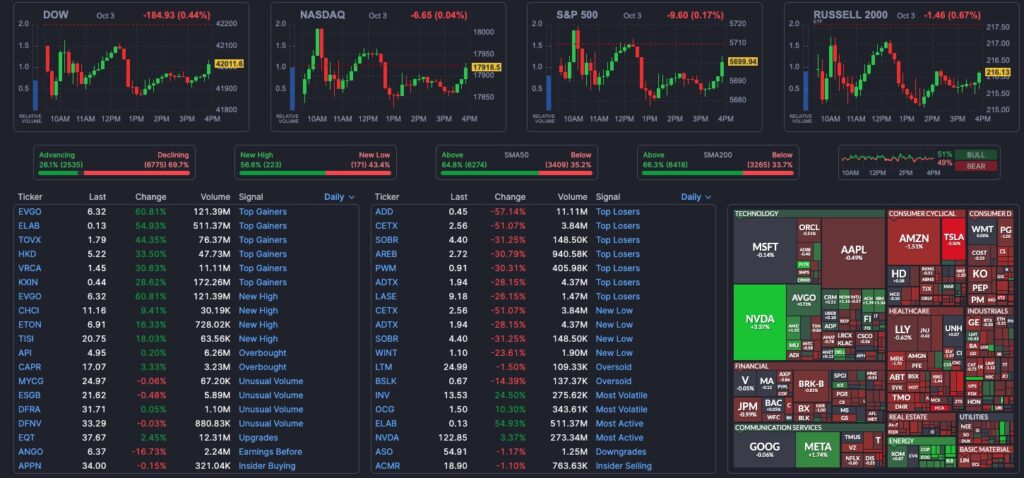

This powerful visual tool allows investors to see market performance at a glance, using colors to represent changes in stocks, sectors, or entire markets. If you’re unfamiliar with market overview heat maps or looking to enhance your analysis process, you’re in the right place. This article dives deep into what market overview heat maps are, how they work, and why you should be using them. Plus, we’ll recommend the best platform for this tool—Finviz—and explain why it’s the go-to choice for serious investors.

What is a Market Overview Heat Map?

A market overview heat map is a graphical representation that helps visualize stock market performance across different sectors and assets. In simple terms, it uses a range of colors—usually shades of red and green—to show changes in price, volume, or other key metrics in real-time. The brighter the color, the more significant the movement. Heat maps are designed to give investors a bird’s-eye view of the market, so they can easily spot trends, identify sector performance, and make informed decisions quickly.

At its core, a heat map makes it easier for you to grasp complex data by using color to indicate value. Whether you’re new to investing or a seasoned professional, heat maps can transform how you approach market analysis by providing an intuitive way to interpret vast amounts of data.

How Does a Heat Map Work in Market Analysis?

The functionality of a market overview heat map lies in its ability to translate raw data into visual patterns. Imagine a table of stock prices, volumes, and percentage changes—this can be overwhelming to interpret in numbers alone. Heat maps simplify this by assigning a color gradient to each value. Stocks that are performing well are often marked in shades of green, while those underperforming might appear in red. The more extreme the value, the brighter the color.

This visual display makes it easy to spot outliers—both high performers and laggards. Instead of scrolling through hundreds of data points, you can get the information you need at a glance.

Key Features of a Market Overview Heat Map

A robust market overview heat map offers several key features to optimize your investment experience:

- Real-Time Data: Access to live data that updates automatically, ensuring that your decisions are based on the latest market movements.

- Customizable Views: Many platforms allow you to filter or customize your heat map to display the sectors, timeframes, or stocks you are interested in.

- Data Layering: Some advanced market overview heat maps offer more than just price changes. They layer in metrics like trading volume, volatility, and even insider buying/selling activity.

- Interactivity: You can often click on a section of the market overview heat map to dive deeper into a specific asset or sector, getting detailed performance reports or news.

With these features, you gain better control over your analysis process, making your investment journey smoother and more efficient.

Why Use a Market Overview Heat Map for Investment?

Heat maps offer a quick, intuitive way to assess market conditions. In just one glance, you can identify which sectors are booming, which are underperforming, and where potential investment opportunities might lie. This gives you a massive advantage when making rapid decisions.

For long-term investors, heat maps help keep tabs on broad market trends, ensuring you stay updated on macroeconomic shifts. If you’re someone who prefers a more active approach, heat maps make it easier to spot short-term opportunities or potential risks, allowing you to time your trades more effectively.

Analyzing Market Trends with Heat Maps

One of the greatest advantages of a market overview heat map is its ability to show you broader trends across sectors and industries. For instance, during times of economic uncertainty, you might see defensive sectors like healthcare and utilities outperforming, while cyclical sectors like travel and leisure could underperform. Heat maps help visualize these shifts, making it easier to decide where to allocate or withdraw investments.

By visualizing trends, heat maps provide investors with a new level of insight that traditional numerical data lacks. Rather than reading countless news articles or reports, you get a concise overview of the entire market or the sectors you’re invested in.

Understanding Sector Performance Through Heat Maps

Sector-specific heat maps are a fantastic tool for investors focused on particular industries. Whether you’re concentrating on tech stocks, energy, or consumer goods, market overview heat maps allow you to focus on one sector while getting a sense of its overall health. For example, if you’re interested in the tech industry, you can use a market overview heat map to compare leading companies like Apple, Microsoft, and Google based on their performance over the past day, week, or month.

Top Platforms for Market Overview Heat Maps

There are many platforms offering heat maps for market analysis, but not all are created equal. Some platforms offer more customization, while others provide better real-time data updates. Here are some of the most popular ones:

- Finviz: Known for its comprehensive and user-friendly market overview heat maps.

- TradingView: Offers heat maps with customizable charting tools.

- Yahoo Finance: A basic yet functional option for beginner investors.

Among these, Finviz stands out as the best overall platform for its simplicity, real-time data, and advanced filtering options.

Why Finviz Stands Out for Heat Maps

When it comes to market overview heat maps, Finviz consistently shines as the top recommendation. I’ve used several platforms over the years, but Finviz has remained my go-to due to its blend of functionality and user-friendliness. With its customizable filters and real-time data updates, Finviz is designed for both novice and experienced investors. Whether you’re checking sector performance or diving deep into individual stock performance, Finviz makes it easy to spot trends and opportunities.

Features of Finviz Heat Maps

When I first started using Finviz, I was blown away by its intuitive design and rich set of features. For those looking to get the most out of market heat maps, here’s why Finviz is a game-changer:

- User-Friendly Interface: Even if you’re a beginner, Finviz makes navigating the world of heat maps easy. The layout is clean and the tools are straightforward, which means less time fumbling with controls and more time analyzing crucial data.

- Customization: Finviz allows you to filter data based on various metrics, like market cap, sector, or performance over different time frames. This gives you the power to tailor the heat map to your specific investment strategy.

- Real-Time Updates: Having access to up-to-the-minute data is crucial for making timely investment decisions. With Finviz, you can trust that the information displayed is fresh and relevant, keeping you ahead of market shifts.

- Comprehensive Data Layers: Beyond price changes, you can overlay other vital metrics such as trading volume, volatility, and even insider trading activity. This is essential when trying to understand why certain stocks are moving.

Using these features has given me the confidence to make smarter, more informed decisions—especially in volatile market environments where every minute counts.

Benefits of Using Finviz for Market Overview Heat Maps

There’s a reason why so many investors rave about Finviz, and after using it for years, I can confidently say that the platform offers immense value. Here are some of the standout benefits:

- Simplicity Meets Power: Finviz strikes the perfect balance between being user-friendly and offering powerful analytical tools. Whether you’re a day trader needing real-time updates or a long-term investor tracking market trends, Finviz caters to both ends of the spectrum.

- Efficiency in Analysis: One of the biggest frustrations in market analysis is the time it takes to sift through endless data. Finviz cuts that time down dramatically by presenting the information visually through its heat maps. With just a glance, you can get an overview of sector performance, stock movement, and market sentiment.

- Enhanced Decision-Making: In the world of investing, timing is everything. By using Finviz’s heat maps, you gain insight into potential investment opportunities that you might otherwise miss. Whether it’s a sudden shift in sector performance or an unexpected stock surge, Finviz keeps you informed in real time.

As someone who thrives on data and insight, Finviz has become my trusted tool. It simplifies complex information and gives me the clarity I need to make confident investment decisions.

How to Get Started with Finviz

For those eager to jump in and experience all that Finviz has to offer, getting started is surprisingly simple. I remember my first time logging in and thinking, “This is it—this is the tool I’ve been looking for.”

- Visit the Finviz Website: Head over to Finviz.com, and right from the homepage, you’ll get a taste of the heat maps they offer. No complex sign-up process or hidden fees—just immediate access to powerful tools.

- Explore the Heat Map Section: At the top menu, you’ll find the “Maps” tab. Clicking on this will take you directly to the heat map interface, where you can start exploring real-time market data.

- Customize Your View: The customization options are where the magic happens. You can filter by sectors, change the timeframe to see intraday vs. weekly performance, and even adjust the metrics displayed.

- Create Watchlists: To make the most of your Finviz experience, you can create watchlists to keep an eye on specific stocks or sectors. This ensures you never miss an important movement in your portfolio.

From the first click, Finviz offers an intuitive experience, making it easy to understand even for those new to heat maps and market analysis.

Practical Tips for Using Heat Maps on Finviz

After using Finviz heat maps for years, I’ve picked up a few practical tips that can help you maximize your experience:

- Focus on Sectors of Interest: While it’s tempting to scan the entire market, zero in on sectors that align with your investment goals. If you’re focused on tech or healthcare, use the sector filters to highlight those areas and monitor them closely.

- Monitor Volume and Volatility: Don’t just look at price changes. Pay close attention to volume and volatility layers on the heat map. High volume or volatile stocks often signal potential trading opportunities or market shifts.

- Use Real-Time Data to Your Advantage: During market hours, keep the heat map open to stay ahead of any sudden changes. If a sector starts turning bright red or green, you’ll be able to react quickly.

- Check Pre-Market and After-Hours Data: Finviz also offers pre-market and after-hours data, which is invaluable for getting a jump on the day’s trading or understanding overnight movements.

These simple strategies can make all the difference when using heat maps to track market performance.

Customizing Your Market Heat Map on Finviz

One of the most powerful aspects of Finviz is its customization capabilities. Whether you’re a day trader or a long-term investor, being able to tailor the heat map to your preferences is a game-changer.

- Time Frame Adjustments: You can choose to view intraday, daily, weekly, or monthly heat maps depending on the type of analysis you’re conducting.

- Filter by Market Cap or Sector: Want to only see large-cap stocks or focus on a specific sector like technology or energy? Finviz lets you filter the map to display only what’s relevant to your portfolio.

- Set Alerts: For those who want to stay ahead of market movements, Finviz allows you to set alerts when a stock or sector meets certain criteria. This is an invaluable feature if you’re looking to act on specific trends.

This level of customization ensures that you’re never bogged down with irrelevant data, allowing you to focus solely on what matters to you.

Tracking Global Markets with Finviz Heat Maps

In an interconnected world, staying informed about global markets is crucial. Finviz excels here, offering heat maps that span international markets, giving you a clear view of how global trends might affect your portfolio.

- Global Market Overview: Whether it’s the U.S., Europe, or Asia, Finviz’s global heat maps give you insights into international markets at a glance. This is particularly useful for understanding broader economic trends or spotting opportunities abroad.

- Currencies and Commodities: Beyond just stocks, Finviz heat maps can also show data for currencies and commodities, giving you a holistic view of the global economy.

Being able to visualize both domestic and international markets in one place has helped me stay ahead of global economic shifts and adapt my investment strategy accordingly.

Comparing Finviz with Other Heat Map Tools

While Finviz is my top recommendation, it’s worth comparing it to other heat map platforms to see how it stacks up:

- TradingView: Offers customizable heat maps with a focus on charting tools. However, it’s less intuitive than Finviz, and some of the more advanced features require a paid subscription.

- Yahoo Finance: A good entry-level platform for beginners, but lacks the depth and real-time updates that Finviz offers.

- StockCharts: Great for technical analysis but falls short on heat map functionality compared to Finviz.

Ultimately, Finviz’s combination of ease-of-use, real-time data, and robust features makes it the best option for most investors.

How Market Heat Maps Assist in Risk Management

Risk management is one of the most critical aspects of investing, and heat maps play a pivotal role in this. By giving you an immediate visual representation of how different sectors are performing, heat maps help you quickly identify underperforming areas of the market.

For example, if you see a lot of red in specific sectors, it might be a signal to reduce exposure or rethink your portfolio allocation. Likewise, spotting green sectors can indicate opportunities for diversification or capitalizing on market momentum. Heat maps give you the tools to adjust your strategy on the fly, minimizing risk while maximizing reward.

Using Heat Maps for Technical Analysis

For traders and technical analysts, heat maps are a fantastic complement to traditional charting tools. By visualizing price movements across a wide range of stocks, you can spot patterns that might not be apparent in standard technical analysis.

Imagine using a Finviz heat map to track stocks that are consistently green over the last few sessions. This can be an indication of bullish momentum, giving you the confidence to make a well-timed trade. Conversely, heat maps also help you avoid stocks that are flashing red, signaling potential sell-offs or weaknesses.

How to Spot Investment Opportunities Using Heat Maps

One of the reasons I love heat maps is how they help me identify opportunities that might otherwise go unnoticed. Here’s how you can use heat maps to spot potential investments:

- Look for Bright Green Clusters: If you see a concentration of green in one sector, it could indicate an upward trend, signaling a potential buying opportunity.

- Monitor Sudden Red Spikes: On the flip side, a cluster of red could be a sign that a sector is oversold, potentially creating a value opportunity for long-term investors.

Visualizing Real-Time Data with Finviz

Having access to real-time data is crucial in today’s market. Finviz excels at this by updating its heat maps in real time, allowing you to stay ahead of the game. Whether you’re watching for price changes, volume spikes, or other key metrics, real-time data ensures that you have the most accurate information at your fingertips.

Analyzing Historical Data with Finviz Heat Maps

Beyond real-time data, Finviz also offers historical data analysis through its heat maps. This is especially useful for long-term investors looking to track trends over time. You can analyze how a stock or sector has performed over the last month, quarter, or year, providing valuable context for future investment decisions.

Common Mistakes to Avoid with Heat Maps

While market overview heat maps are incredibly powerful, it’s important to avoid common pitfalls:

- Over-reliance on Color: Don’t just rely on the color of the heat map. Always dive deeper into the data to understand what’s driving the price movement.

- Ignoring Volume: A green stock may look attractive, but if it has low trading volume, it may not be a solid investment. Be sure to check all metrics, not just price changes.

Avoiding these mistakes has helped me get the most out of my Finviz heat map experience, and it will help you too.

How to Interpret Color Coding in Market Heat Maps

Understanding the color coding in heat maps is essential for accurate analysis. Typically, green indicates gains, while red signals losses. Darker shades represent smaller movements, whereas brighter colors indicate more significant changes. Learning to interpret these subtle differences will improve your ability to react to market changes quickly.

Frequently Asked Questions (FAQs)

What is a market overview heat map? A market overview heat map is a visual tool that uses color coding to represent changes in stock prices, volume, or other key metrics across sectors.

How do heat maps help investors? Heat maps provide a quick, easy way to spot market trends and sector performance, helping investors make more informed decisions.

What is the best platform for market overview heat maps? Finviz is one of the best platforms for market heat maps due to its real-time updates, ease of use, and robust feature set.

Can heat maps track global markets? Yes, platforms like Finviz offer global heat maps, giving investors insight into international market trends.

Are heat maps useful for technical analysis? Absolutely. Heat maps complement traditional technical analysis by helping traders visualize price movements across multiple stocks.

How can I get started with Finviz? Visit Finviz.com to explore their heat map tools and customize your view based on sectors, stocks, or other preferences.

Conclusion

After years of using market overview heat maps, I can confidently say they are a must-have tool for every investor. Whether you’re new to investing or a seasoned pro, heat maps simplify complex data, providing you with the insights needed to make smarter decisions. Finviz stands out as the premier platform for heat maps, offering customization, real-time data, and an intuitive interface that makes market analysis easier and more effective.

If you’re ready to level up your investment game, I highly recommend exploring Finviz heat maps. The power to visualize market trends, spot opportunities, and manage risk is just a click away.

Also Read: