Stock Market Historical Events

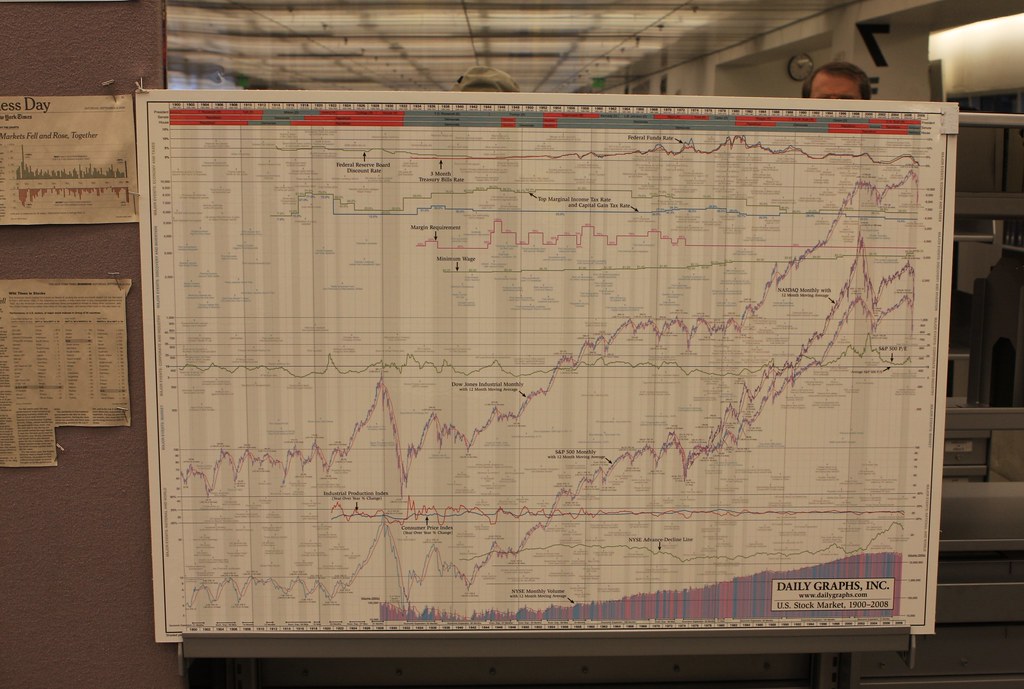

The stock market is a living, breathing entity—an intricate ecosystem of emotions, economics, and history. For any investor, understanding its most significant historical moments isn’t just about reading headlines from the past. It’s about learning lessons that can guide future decisions. Let’s dive deep into the most memorable stock market events and the emotions they stirred up, and how these events continue to affect today’s investors.

The Emotional Rollercoaster of the Stock Market

The stock market has seen its fair share of triumphs and tragedies. For every euphoric high, there has been an equally devastating low. And if you’re an investor, it’s crucial to understand that these events are more than just dates on a calendar. They represent emotions—fear, greed, hope—that drive the markets and, ultimately, influence your portfolio.

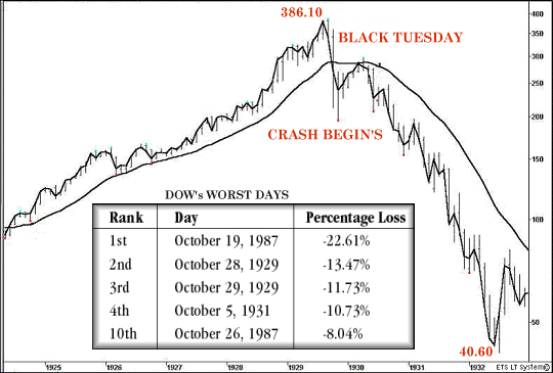

The Great Depression – A Crash Like No Other

Date: October 24, 1929 (Black Thursday)

In the autumn of 1929, optimism and euphoria filled the air. The economy was booming, and people believed that the good times would last forever. However, on Black Thursday, that belief shattered into pieces. The stock market crashed, losing nearly 25% of its value in just a few days, marking the start of the Great Depression. Investors watched in horror as their wealth evaporated.

Businesses collapsed, banks failed, and millions of people were thrown into poverty. It was a time of widespread fear and uncertainty. The lesson for modern investors? Even the most robust bull markets can end in disaster, often when least expected. Be cautious when optimism turns into overconfidence.

The 1987 Crash – Fear Strikes Again

Date: October 19, 1987 (Black Monday)

Fast forward almost 60 years to Black Monday. This was the worst single-day loss in stock market history, with the Dow Jones Industrial Average plummeting by 22.6%. Unlike the Great Depression, there were no clear economic red flags leading up to the crash. It was driven primarily by computerized trading and panic selling.

The emotional toll was intense, as investors scrambled to make sense of what was happening. One moment, everything seemed stable, and the next, chaos reigned. This event reminded investors that the market can crash even when the economy appears healthy. In today’s world, with algorithms and artificial intelligence playing an ever-increasing role, the lessons of Black Monday remain vital.

The Dot-Com Bubble – Greed Takes Over

Date: 1997-2000

In the late 1990s, technology stocks soared to unimaginable heights. The rise of the internet sparked dreams of limitless profit, and investors piled into tech companies, many of which had no profits and no clear business models. It was a classic case of irrational exuberance. As the bubble grew, so did investor greed. Everyone wanted a piece of the tech boom.

But when the bubble finally burst in 2000, it wiped out trillions of dollars in wealth and left many investors stunned. The dot-com bubble is a stark reminder that chasing trends without solid fundamentals can lead to disastrous results. Greed can blind investors to the warning signs of an impending crash.

The 2008 Financial Crisis – A Lesson in Fear

Date: September 2008

Few events have caused as much fear and uncertainty as the 2008 financial crisis. Triggered by the collapse of Lehman Brothers and the subprime mortgage meltdown, the crisis spread like wildfire across the globe. Stock markets plummeted, wiping out years of gains in a matter of weeks.

The emotional impact was profound. People lost their homes, their savings, and their jobs. The fear was palpable, and many investors sold their stocks at the bottom, locking in massive losses. The lesson here? Fear can lead to irrational decision-making. Those who held their nerve and stayed invested eventually saw the market recover and even thrive in the years that followed.

COVID-19 Pandemic – Hope Amidst Uncertainty

Date: March 2020

When the COVID-19 pandemic struck in early 2020, it sent shockwaves through the global economy. Stock markets plunged as countries went into lockdown, businesses shuttered, and uncertainty loomed large. Yet, unlike previous crises, this one saw a remarkably quick recovery, driven by unprecedented government stimulus and the rapid adaptation of businesses to the new normal.

For investors, the pandemic was a stark reminder of the market’s unpredictability. But it also highlighted the importance of hope and resilience. Those who stayed invested during the initial crash were rewarded with one of the fastest rebounds in history. The emotional lesson? Sometimes, even in the darkest times, hope can prevail.

Lessons for Modern Investors

The history of the stock market is filled with emotional highs and lows.

But what can modern investors learn from these historical events?

- Emotions Drive Markets

- Fear and greed are powerful forces that drive market movements.

- Being aware of these emotions and learning to control them can make all the difference.

- Diversification is Key

- No matter how promising a single stock or sector may seem, diversification remains one of the best strategies for managing risk.

- Stay the Course

- Markets have always recovered from downturns, and those who stay invested during tough times often come out ahead.

The Future – A New Chapter in Stock Market History?

As we look to the future, the stock market continues to evolve. New technologies, shifting global dynamics, and emerging industries will all shape the market’s trajectory. But if history has taught us anything, it’s that emotions—fear, greed, hope—will always play a role in shaping the market’s path. Investors who understand these emotional drivers and learn from the past are better equipped to navigate the future. The stock market may be unpredictable, but the lessons of history can help guide us through the next chapter.

Final Thoughts

The stock market’s history is filled with dramatic events that have shaped the world. From the Great Depression to the COVID-19 pandemic, these moments have left lasting impacts on both the economy and individual investors. As we continue to invest, it’s essential to remember the emotional lessons of the past. After all, the market is more than just numbers on a screen—it’s a reflection of human nature, in all its triumphs and tragedies.

Key Takeaways _ Stock Market Historical Events: What Every Investor Should Know

- The stock market has always been and will always be influenced by emotions like fear, greed, and hope.

- Understanding the lessons from historical events can help modern investors make better decisions.

- Staying calm during market downturns often leads to better long-term results.

- Diversification is a timeless strategy for managing risk.

By reflecting on these emotional and historical lessons, you can approach your investments with a deeper understanding of how the market truly works—beyond just the numbers.

Sources:

Also Read: