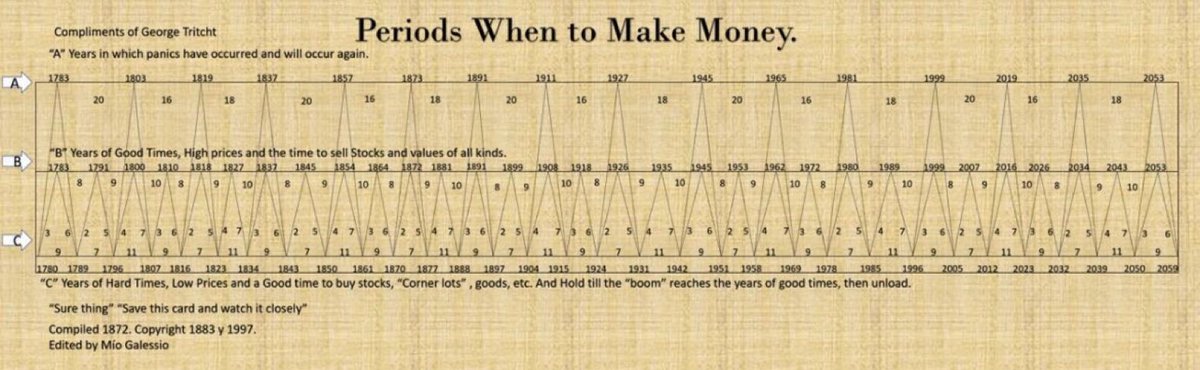

The Benner Cycle, a long-standing market prediction tool developed by Samuel Benner in the late 1800s, has gained renewed attention as we approach 2025. This model identifies recurring periods of “good times,” “hard times,” and “panic years” in market behavior, based on historical economic data. While it is not without its skeptics, the Benner Cycle has proven accurate in forecasting key market trends over the past century, especially for long-term investors.

Understanding the Benner Cycle

The Benner Cycle is essentially a chart that maps out cyclical patterns in the stock market over decades. These cycles are broken into phases such as “years of good times” where stock prices are high and it’s considered the optimal time to sell, “years of hard times” when prices are low and stocks are best to buy, and “years of panic” where irrational selling or buying drives prices to extreme highs or lows.

Benner’s theory is based on the idea that market movements are not random, but follow predictable cycles tied to economic and societal factors. These cycles are divided into both major and minor periods, with some spanning as long as 54 years. Each cycle includes bullish (favorable) and bearish (unfavorable) phases, where major market corrections or crashes often occur. Historically, the Benner Cycle has coincided with major financial events, making it a potentially valuable tool for investors looking to time the market. (The Rational Investor)(Quantara)

What Does 2025 Hold?

As we approach 2025, the Benner Cycle indicates that we could be entering a “hard times” phase, a period typically marked by economic contraction, lower stock prices, and heightened volatility. According to Benner’s model, after the relatively prosperous years that many markets experienced from 2020 to 2022, this new phase may bring challenges, with increased risk of market downturns.

However, “hard times” do not necessarily equate to total financial loss. In fact, Benner’s philosophy suggests that these periods are excellent times for long-term investments, as stock prices are often undervalued, presenting opportunities for those who can weather the volatility. Benner predicted that during these downturns, investors could accumulate undervalued assets and hold them until the next “good times” period arrives, typically within 3 to 5 years. (Quantara)(Sentimentrader)

Current Market Sentiment

Today’s financial analysts are watching the Benner Cycle with interest, especially as global markets continue to navigate economic headwinds like inflation, rising interest rates, and geopolitical instability. Some experts see the potential for a stock market correction in the next 12 to 18 months, aligning with Benner’s predicted shift into a less favorable market phase.

As with any cyclical model, though, it’s essential to combine Benner’s insights with other market indicators, such as economic reports and central bank policies, to form a more comprehensive investment strategy. (Sentimentrader)(Price Action Lab)

Is the Benner Cycle Reliable?

While the Benner Cycle has been historically accurate in many cases, it should not be viewed as a definitive market-timing tool. Its primary value lies in its ability to provide context for understanding long-term market cycles. For example, major corrections predicted by the Benner Cycle often occur after periods of speculative bubbles, which we’ve seen in recent years with the rise of cryptocurrencies and tech stocks.

Moreover, volatility during unfavorable years tends to be higher, suggesting that investors may need to adopt more conservative strategies, such as hedging or increasing exposure to defensive sectors, during these periods. While the cycle can provide clues about potential market downturns, it’s important to remember that market behavior is also influenced by unpredictable external events like pandemics or political crises. (Quantara)(Wikipedia)

How to Prepare for 2025

For investors, the key takeaway from the Benner Cycle is to be mindful of the long-term outlook. The 2025 cycle suggests a shift into less favorable market conditions, but this doesn’t mean investors should abandon the market altogether. Instead, this could be an ideal time to focus on accumulating quality assets at lower prices, positioning for the eventual upswing in the next favorable phase.

In conclusion, the Benner Cycle’s forecast for 2025 points to a more challenging environment, but also one filled with opportunities for patient, informed investors. Whether or not you place full confidence in Benner’s predictions, understanding these cycles can provide valuable insights into how markets might behave in the coming years. The key is to remain disciplined, avoid panic, and take advantage of market downturns to prepare for the next “good times” period.

Sources:

Also Read:

Ref: