When considering real estate transactions or investments, many beginners tend to focus only on basic factors such as price, location, and size. However, one of the more crucial concepts that determines both the use and value of real estate is Zoning. Zoning is an essential element that every investor should be aware of, as it plays a major role in shaping the utility and profitability of a property.

In this article, we’ll explain the concept of zoning, its various types, and how to use zoning effectively in overseas real estate investments.

What is Zoning?

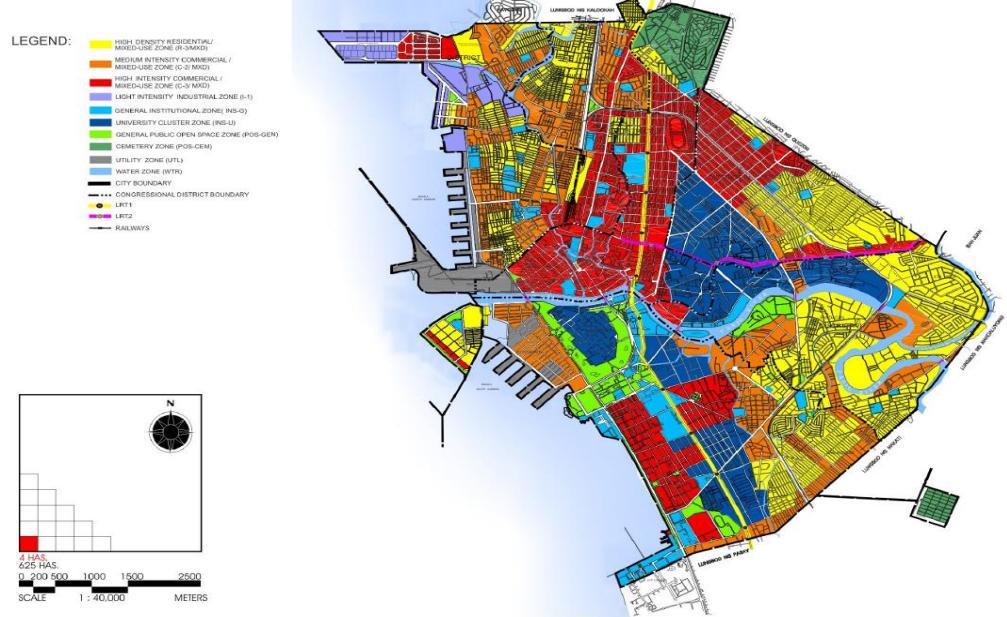

Zoning is a legal system that regulates and restricts land usage, typically designated by governments or local municipalities. Zoning regulations are used to plan city development, protect the quality of life for residents, and determine how buildings in a specific area can be used. For example, a residential area may be restricted from having commercial buildings, or certain businesses may be prohibited from being established in specific commercial zones.

Zoning laws vary depending on the country and city. For instance, in the United States, zoning laws are often created at the city or county level, while in Europe or other countries, zoning regulations may differ by region. Therefore, understanding local zoning laws is crucial when investing in overseas real estate.

Types of Zoning

Zoning is generally categorized based on the intended land use. The main types include.

- Residential Zoning:

- This allows for housing, such as single-family homes, apartments, and townhouses.

- Commercial or industrial activities are restricted here, though specific rules might permit multi-family units.

- Commercial Zoning:

- This zone allows for businesses such as retail shops, offices, restaurants, and hotels.

- There may be additional restrictions depending on the type of business.

- Industrial Zoning:

- Designed for factories, warehouses, and manufacturing.

- Residential and most commercial activities are restricted due to potential noise and pollution.

- Mixed-Use Zoning:

- This zoning allows for both residential and commercial activities.

- Such areas often encourage urban redevelopment and may host buildings with commercial spaces on the ground floor and residential spaces above.

- Agricultural Zoning:

- Reserved for farming, livestock, and crop cultivation. Commercial and residential activities are usually limited.

- Special Purpose Zoning:

- These zones are designated for parks, schools, hospitals, or religious facilities, with very limited alternative uses allowed.

How Zoning Impacts Real Estate Value

Zoning not only limits how land can be used, but it also directly influences the value of real estate. For example, properties in a commercial zone often have higher value due to their potential for generating income through business activities. On the other hand, residential properties may have lower value unless they’re situated in prime locations.

Zoning changes can also lead to fluctuations in property value. For instance, if a residential area is re-zoned to commercial, demand for property in that area might increase, causing prices to rise. Conversely, a commercial zone that is re-designated as industrial or agricultural could see a decrease in value.

How to Use Zoning in Overseas Real Estate Investments

When investing in overseas real estate, it’s essential to have a thorough understanding of zoning regulations to make informed decisions.

Here are some ways to use zoning effectively.

- Check Zoning Regulations:

- Before investing, verify the zoning rules of the area.

- This will help you determine the potential use of the property and shape your long-term investment strategy.

- Look for Zoning Change Opportunities:

- Areas undergoing redevelopment or planning zoning changes can be great investment opportunities, as property values may rise when the zoning is altered.

- Manage Risks Due to Zoning Restrictions:

- Be aware of the limitations that zoning laws may impose on your property.

- If a region has strict zoning regulations, it might hinder business expansion or limit property development.

- Make sure to choose zoning that aligns with your investment goals.

Conclusion

Zoning is not just a legal framework that determines how a property can be used; it also significantly impacts the property’s value and potential for future growth. For overseas investors, understanding zoning laws and using them strategically is crucial for successful investments. Properly leveraging zoning can lead to stable returns and long-term investment value. Thank you for reading, and best of luck with your real estate investments!

Also Read:

https://www.investopedia.com/terms/e/eps.asp

https://www.stockguidebook.com/quitclaim-deed-the-essential-guide-to/