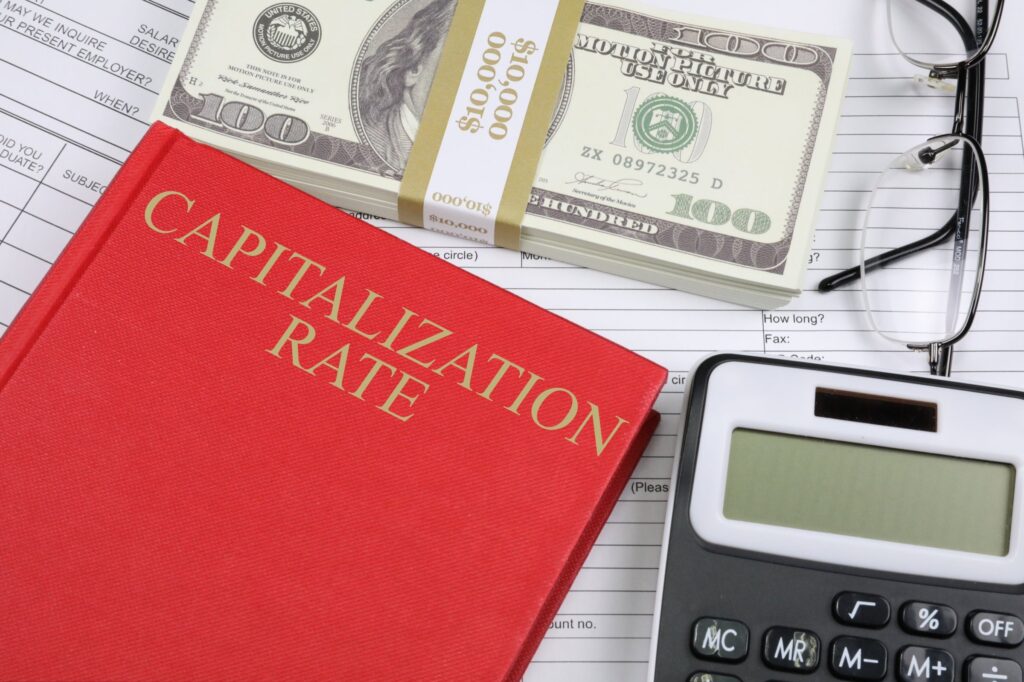

For those who are just beginning to explore real estate investment, you may have come across a key indicator called CAP Rate (Capitalization Rate). The CAP Rate is an essential tool that helps investors easily evaluate the profitability of a property.

In this blog, we’ll break down what CAP Rate is, how to calculate it, and why it plays a crucial role in real estate investing.

What is CAP Rate?

CAP-Rate, short for Capitalization Rate, is a metric used to assess the return on a real estate investment. It is calculated by dividing the Net Operating Income (NOI) generated by the property by the property’s current market value. Simply put, it measures the property’s ability to generate income in relation to its value.

CAP Rate Formula:

CAP Rate = (NOI ÷ Property Market Value) x 100

CAP-Rate allows investors to compare the profitability of different properties efficiently. It helps you assess how much return you can expect from an investment property.

Key Components for CAP Rate Calculation

To calculate CAP-Rate accurately, you’ll need two essential factors.

- Net Operating Income (NOI)

- The NOI is the annual income generated from the property, minus operating expenses like maintenance costs, property taxes, and repairs.

- For instance, if a rental property earns $50,000 in rent annually but has $10,000 in operating expenses, the NOI would be $40,000.

- Property Market Value

- The property’s current market value refers to its present selling price or appraised value.

- You can estimate this value based on recent sales of similar properties in the area.

Example of CAP Rate Calculation

Let’s consider a property with an annual rental income of $50,000 and operating expenses of $10,000. The NOI would be $40,000. If the current market value of the property is $500,000, then the CAP-Rate would be.

CAP Rate = ($40,000 ÷ $500,000) x 100 = 8%

In this case, the CAP-Rate is 8%, which indicates the property generates an 8% return on its value annually.

How to Interpret CAP Rate

A higher CAP-Rate suggests that the property generates a higher return, while a lower CAP-Rate indicates a lower return.

However, a high CAP-Rate doesn’t always mean a property is a better investment—it could indicate higher risk.

- High CAP Rate :

- Properties with high CAP-Rates typically offer higher returns, but may come with higher risk.

- These are often located in less desirable areas or may face market volatility.

- Low CAP Rate :

- Properties with lower CAP-Rates are usually in prime locations or more stable markets, meaning they might offer steady, albeit lower returns, and are considered lower risk investments.

Importance of CAP Rate in Real Estate

CAP-Rate is crucial because it allows real estate investors to compare different properties quickly and make informed decisions about their investments. When analyzing multiple properties, investors can use the CAP-Rate to determine which property might yield the highest return with the least effort.

Additionally, the CAP-Rate helps assess whether a property is overvalued or undervalued based on its income potential. For example, if the average CAP-Rate in a particular area is 6% but the property you’re considering has a CAP-Rate of 4%, this may indicate that the property is overpriced compared to others in the area.

Limitations of CAP Rate

While the CAP-Rate is a powerful tool, it does have its limitations.

- Future Value is Not Considered :

- CAP-Rate is based on current NOI and property value, but it doesn’t account for future appreciation or changes in the market.

- Operating Costs Can Vary :

- The NOI might change over time due to fluctuating operating costs like repairs or property taxes, which could affect the CAP-Rate.

- Risk Is Not Factored :

- A high CAP-Rate may reflect a higher-risk property.

- Factors like the property’s location or the local economy are not taken into account in the CAP-Rate calculation.

Conclusion

In summary, the CAP Rate is a fundamental metric in real estate investing that helps investors evaluate the profitability of a property. By understanding how to calculate and interpret CAP Rate, you can make more informed investment decisions and quickly compare multiple properties to determine the best opportunities.

However, it’s essential to use CAP Rate in conjunction with other financial metrics and consider external factors like market conditions, property risks, and future growth potential. This balanced approach will lead to more successful and thoughtful real estate investments. Investing in real estate can be profitable, and mastering the use of CAP Rate is a critical step toward making smarter investment choices.

Also Read:

https://www.investopedia.com/terms/e/eps.asp

https://www.stockguidebook.com/firpta-tax-law-5-essential-things-foreign/