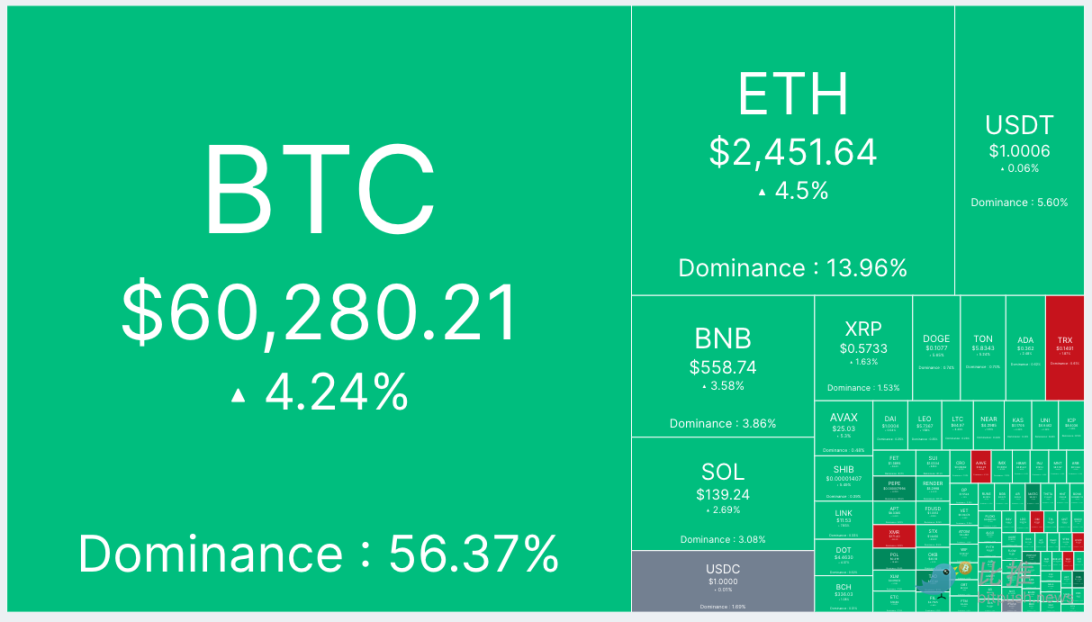

Yesterday, Bitcoin surged by over 6%, reclaiming the $60,000 mark and drawing significant attention from investors. The recent rally seems to be driven by the growing expectation that the Federal Reserve (Fed) will implement a rate cut, which has created a positive ripple effect across the markets. Bitcoin, in particular, is highly sensitive to macroeconomic policies, as monetary policies like interest rate changes directly influence liquidity in the market, affecting Bitcoin’s price. In this post, we’ll explore how Fed rate cut expectations fueled this price surge and what the future holds for Bitcoin.

Relationship Between Bitcoin & Rate Cuts

Unlike traditional financial assets, BTC is indirectly affected by central bank policies. When interest rates decrease, liquidity in the market increases, prompting investors to allocate funds into riskier assets, often leading to more aggressive investments. Bitcoin, with its unique characteristics, tends to attract substantial inflows during periods of lower interest rates due to its higher volatility and potential for higher returns.

Throughout 2024, the Fed has maintained a tight monetary policy to control inflation. However, with recent signs of an economic slowdown in the U.S., there are signals that the Fed might pivot towards rate cuts. This speculation has driven investor interest towards risk assets like Bitcoin, contributing to the sharp price increase we witnessed.

Is the Rate Cut Speculation Driving the Surge?

In situations where a rate cut is expected, investors often shift their funds from traditional assets into alternative ones with potentially higher yields. Bitcoin is seen as an appealing alternative, especially when compared to traditional assets like stocks and bonds due to its volatility and potential for substantial profits.

The 6% price surge aligns with growing market speculation that a Fed rate cut could materialize soon, leading to a spike in BTC demand. A rate cut would likely weaken the value of the U.S. dollar, driving more interest toward Bitcoin as an alternative investment. Investors seem to be anticipating dollar weakness and increased liquidity, which spurred massive purchases of Bitcoin.

Is Bitcoin Becoming a Safe-Haven Asset?

More recently, Bitcoin has also been viewed as a safe-haven asset, similar to gold or silver. During periods of financial uncertainty, investors seek to move their capital into safe-haven assets. Bitcoin, often dubbed “digital gold,” has increasingly adopted this role over the past few years. This recent surge can also be attributed to a combination of rate cut expectations and growing concerns over the stability of the traditional financial system.

As investors become more uncertain about traditional markets, Bitcoin becomes an attractive option as a hedge against potential risks. Although the Fed’s rate cuts aim to stimulate economic activity, some investors worry that such policies could re-ignite inflation. In that scenario, BTC could become even more attractive as a hedge against inflation since it operates independently from central bank control.

What Lies Ahead for Bitcoin?

While Bitcoin’s recent surge presents a positive signal for investors, it’s essential to recognize that high volatility often accompanies these gains. Bitcoin’s price is extremely sensitive to external factors, and this recent surge due to rate cut speculation is no exception. If the Fed doesn’t cut rates or if the market’s expectations are not met, BTC could experience sharp price corrections.

However, many experts remain optimistic about Bitcoin’s long-term potential. They believe the fundamental supply-demand dynamics of Bitcoin could support sustained price growth, with this recent surge marking the potential beginning of a new bull market. Increased participation from institutional investors and the possibility of a Bitcoin ETF approval are also seen as factors that could further solidify Bitcoin’s value.

From a technical perspective, this price rally holds importance. Looking at historical price patterns, Bitcoin has often experienced short-term corrections after sharp rallies, but its long-term trend has remained upward. Therefore, it’s crucial for investors to account for Bitcoin’s volatility while also considering long-term growth opportunities.

Conclusion

Yesterday’s 6% surge in Bitcoin is closely linked to growing expectations of a Fed rate cut, signaling that Bitcoin is regaining its position as a preferred alternative asset. As the market continues to speculate on monetary policy shifts, Bitcoin’s price could see further fluctuations. It’s vital for investors to remain cautious while adjusting their strategies to account for both the risks and opportunities present in the evolving macroeconomic landscape.

For further reading:

https://decrypt.co/249952/bitcoin-etfs-add-250-million-surge-ahead-expected-rate-cut

Also Read:

https://www.investopedia.com/terms/e/eps.asp

https://www.stockguidebook.com/2025-yen-carry-trade-will-unwinding-shape/