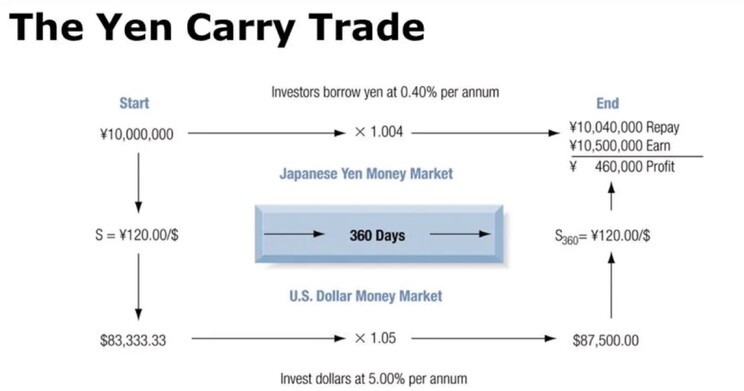

The Yen carry trade refers to a strategy where investors borrow Japanese yen at low-interest rates and invest in currencies with higher interest rates. This method allows investors to profit from the interest rate differential, making it an attractive opportunity for many. However, when interest rates fluctuate or market instability increases, these trades face the risk of unwinding, which could trigger significant financial shifts.

Recently, with the rapidly changing global economic landscape, discussions around the unwinding of the yen carry trade have intensified. This post will explore what happens if the yen carry trade unwinds and how that could impact the Japanese yen exchange rate in 2025.

What is the Yen Carry Trade?

The Yen carry trade leverages Japan’s low-interest-rate environment, which has persisted for decades. Japan has maintained extremely low, sometimes zero interest rates, allowing investors to borrow yen and invest in other currencies with higher yields. Consequently, the yen has become a funding currency in global financial markets, playing a crucial role.

In essence, the strategy involves borrowing yen and investing in high-yield assets. However, this approach can be unstable depending on market conditions. If interest rates rise or market conditions deteriorate, investors may rush to convert their investments back to yen, leading to a large-scale unwinding and strengthening of the yen.

Why Is Yen Carry Trade Unwinding Frequently Discussed Recently?

In recent years, the global economy has seen a sustained low-interest-rate environment, but starting in 2022, many countries began raising interest rates to combat inflation. Central banks, including the Federal Reserve, implemented aggressive rate hikes, reducing the attractiveness of the yen carry trade.

The narrowing interest rate gap and the weakening risk appetite have prompted many investors to begin unwinding their carry trade positions. As the interest rate gap between Japan and the US narrows, the yen’s depreciation has somewhat paused, and there’s growing speculation that the yen could strengthen. As interest rates rise globally, funds invested in higher-yielding currencies could flow back into safer assets, like the yen, driving its value up.

Future Outlook for the Japanese Yen Exchange Rate

If the yen carry trade unwinds significantly, the Japanese yen is likely to appreciate. This is because investors would convert their high-yield investments back into yen, driving up demand. For a long time, the yen has been in a weakened position, but an unwinding process could lead to a gradual strengthening of the currency.

Looking ahead to 2025, two main factors will influence the yen’s trajectory: global interest rate policies and Japan’s own monetary decisions. If Japan continues its policy of interest rate freezes, while other countries maintain high-interest rates, the yen could weaken again. However, a swift unwinding of carry trade positions could accelerate yen appreciation, especially if investor sentiment shifts quickly.

For example, the USD/JPY exchange rate has fluctuated within the 140-150 yen range in recent years, but if the yen carry trade unwinds, this range could drop below 130 yen. Similar movements occurred during past financial crises, where yen appreciation followed large-scale carry trade unwinds.

What Happens If the Yen Carry Trade Unwinds?

The unwinding of the yen carry trade would not only increase volatility in the yen but also impact the global financial markets. The yen is often regarded as a safe-haven asset, so when markets become unstable, investors tend to flock to the yen as a hedge against risk.

This shift could ripple through the stock and bond markets, causing significant disruptions. Unwinding could also trigger the sudden withdrawal of funds from riskier assets, such as emerging market currencies or high-risk investments. This could lead to liquidity shortages and increased global financial instability.

Advice for Investors and Summary

If the yen carry trade unwinds, it could introduce significant volatility into the financial markets. Investors should take extra care to manage risk in such scenarios. With the likelihood of yen appreciation, it might be necessary to adjust strategies that rely on the yen’s depreciation. Moreover, if the carry trade unwinding progresses, Japanese exporters could face difficulties due to the yen’s strength, impacting Japan’s economy more broadly.

Therefore, analyzing and forecasting industries that are sensitive to currency fluctuations is critical. The unwinding of yen carry trades has become a key topic in the global financial landscape. With the continued rate-hike trend, the likelihood of unwinding is rising. In such a scenario, the yen is expected to strengthen, so it’s important to closely monitor how these exchange rate changes will affect financial markets. Investors should always employ risk management strategies and flexible investment approaches in uncertain times.

For further reading:

Also Read:

https://www.investopedia.com/terms/e/eps.asp

https://www.stockguidebook.com/how-the-openai-o1-strawberry-model-could/