The stock market in September 2024 is going through a period of significant changes, with two key factors set to drive volatility: the upcoming Quadruple Witching Day and expectations surrounding the Federal Reserve’s potential rate cut. These two elements are likely to combine and shake the markets, creating an environment of uncertainty and turbulence for investors. In such periods, multiple variables interact simultaneously, potentially leading to heightened market swings.

What is Quadruple Witching Day and its Impact?

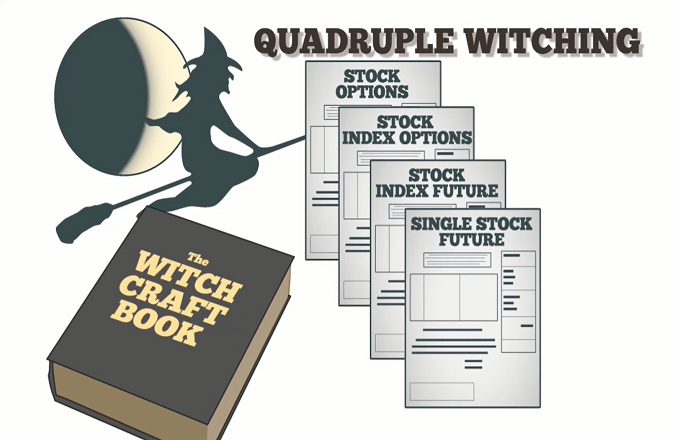

Quadruple Witching Day occurs when four types of derivatives—stock options, stock futures, index options, and index futures—expire simultaneously. This happens on the third Friday of March, June, September, and December each year. Specifically, September often experiences the most significant volatility due to its overlap with seasonal market fluctuations. During Quadruple Witching, traders typically adjust their positions, leading to large-scale buying and selling.

This can result in rapid market movements, causing stocks to spike or plunge unexpectedly. The market uncertainty peaks, and price swings are more pronounced than on regular trading days. As a result, investors should brace themselves for sharp price movements and prepare to manage these fluctuations strategically. September 2024’s Quadruple Witching Day is receiving particular attention because it coincides with the anticipated rate cut by the Federal Reserve (Fed)(Jordan Alexo).

Will a Rate Cut Save or Sink the Market?

Since 2022, the Federal Reserve has been aggressively raising interest rates to combat inflation. As a result, the U.S. federal funds rate has reached its highest point in 23 years. However, in 2024, signs of an economic slowdown have emerged, increasing speculation that the Fed will lower interest rates. Inflation is beginning to subside, and the labor market is softening, making rate cuts a critical issue for economic recovery.

While rate cuts are generally seen as positive for the stock market, as they lower borrowing costs for companies and boost consumer spending, they are not a cure-all for economic problems. Some analysts are concerned that a rate cut could signal the start of a recession, with the Fed’s intervention merely delaying the inevitable.

This September, two conflicting scenarios are unfolding. The first suggests that the Fed’s rate cut could be seen as a positive signal, driving a stock market rebound. The second scenario involves the uncertainty of Quadruple Witching, which could lead to greater volatility and a potential market downturn, despite the rate cut optimism(Jordan Alexo)(Ahrefs).

What Happens When Quadruple Witching and Rate Cuts Collide?

The convergence of Quadruple Witching and the potential Fed rate cut in September signals heightened volatility. Such volatility can offer lucrative opportunities for investors but also presents significant risks. In the short term, rate cut expectations may fuel market rallies, but the substantial trading volume on Quadruple Witching Day may also trigger massive sell-offs. The impact of a rate cut on the market is still uncertain.

Historically, rate cuts tend to support stock prices, but this is contingent on broader economic improvements. If the cut is seen as a temporary fix to an underlying recession, the market could experience a temporary bounce followed by a steep decline. Given the volatility associated with Quadruple Witching, investors may overreact to market signals, amplifying market swings(Hunter & Scribe).

Strategies for Navigating Volatility

Investors need to focus on managing volatility during such turbulent times.

The best strategies involve.

- Diversifying risk across sectors and assets.

- Reducing exposure to high-risk assets like technology stocks and growth-oriented sectors, while considering safer investments like dividend stocks or defensive sectors, can help mitigate risks.

- Avoiding knee-jerk reactions to short-term market movements.

- While the September volatility may be unavoidable, maintaining a long-term perspective can prevent panic selling.

- It’s essential to avoid making emotional decisions, especially during volatile periods like Quadruple Witching.

Conclusion

September 2024 is shaping up to be a highly uncertain and volatile period for the stock market. The combination of Quadruple Witching and the Fed’s potential rate cut could drastically shift market dynamics, with investors facing a multitude of challenges. To navigate this period successfully, investors should remain vigilant, diversify their portfolios, and avoid overreacting to short-term market swings. By preparing for volatility, they can better manage risks and capitalize on potential opportunities.

For further reading:

Federal Reserve Rate Cut Expectations in Focus(Jordan Alexo)

Why September Might Bring Market Chaos(Ahrefs)

Also Read:

https://www.investopedia.com/terms/e/eps.asp

https://www.stockguidebook.com/2024-u-s-election-how-will-trump-vs-harris/