NVIDIA Stock Shock : 3 Reasons for the Decline After Hitting Its Peak

NVIDIA has been a leading company in recent years, spearheading next-generation technologies such as Artificial Intelligence (AI), autonomous driving, and the metaverse, earning remarkable attention in the stock market. NVIDIA’s stock price soared to unprecedented highs due to these cutting-edge innovations. However, it has recently taken a sharp downward turn.

What’s Causing the Stock Decline? (Short-Term Factors)

NVIDIA’s current stock decline can be attributed to several factors.

First, global economic uncertainty has played a major role. Ongoing interest rate hikes and inflation have destabilized stock markets worldwide, and growth-focused tech stocks have been particularly hard hit. NVIDIA, as a high-growth tech stock, has been similarly affected. Tech stocks are typically priced based on future earnings expectations, but when interest rates rise, those expectations get discounted, leading to a decrease in stock value.

Second, issues with the global semiconductor supply chain are also to blame. While NVIDIA holds a dominant position in the GPU and chip markets, ongoing semiconductor shortages have led to production and supply disruptions. For example, the release of their new AI chip, Blackwell, has faced delays. As a result, investor expectations for revenue growth have diminished, contributing to the stock’s decline.

Lastly, overly optimistic expectations about AI and autonomous driving technologies are another reason for the drop. While NVIDIA is a leader in these fields, it’s important to recognize that it will still take time before these technologies are widely commercialized. Many investors bought into the stock with these future prospects in mind, but disappointment regarding delayed revenue generation has likely led to the recent price drop.

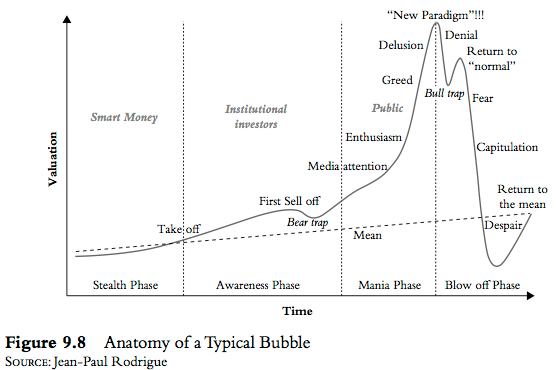

Warning Signs: Speculative Buying and Denial of Reality

Despite the steep drop in stock price, some investors continue to speculatively buy NVIDIA shares, aiming for short-term gains or attempting to catch the dip. Many are driven by the belief that because NVIDIA leads in AI and autonomous driving, its stock is bound to rebound soon. This speculative buying is often based more on blind optimism than on a rational assessment of the company’s long-term growth prospects. Additionally, many investors seem to be in denial about the current stock decline.

After seeing NVIDIA’s explosive growth in recent years, it’s hard for some to accept the fact that its stock price can fall. In the tech sector, especially, there’s a prevailing mindset of “AI is the future, so the stock will inevitably go back up soon,” but this overly optimistic view can be dangerous. Investors need to remember that the stock market is always uncertain, and prices can fluctuate based on many factors, including company performance, market conditions, and global events.

This speculative buying and refusal to acknowledge reality can pose significant risks, especially in times of global economic instability. When market volatility is high, strategies like short-term rebound trading or trying to buy the dip can lead to major losses, especially if leverage is involved. Investors need to be cautious about being overly optimistic during these periods.

What Should Long-Term Investors Do?

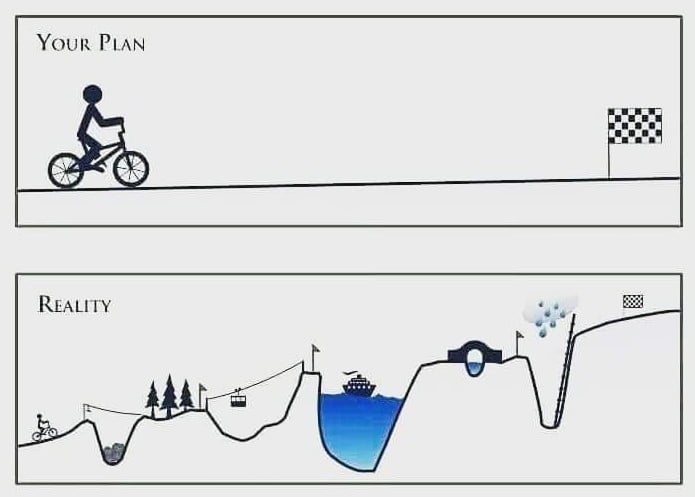

For long-term investors, it’s important to remain calm during periods of short-term market fluctuations and focus on the company’s fundamentals. While NVIDIA’s stock may be declining in the short term, it still possesses groundbreaking technology in AI, autonomous driving, and the metaverse, all of which will likely drive substantial growth in the future. From a long-term perspective, AI and autonomous driving technologies are expected to see tremendous growth in the coming years.

NVIDIA is a leader in both hardware and software in these sectors, so once these technologies become commercially viable, the company stands to reap significant profits. NVIDIA’s semiconductors and chips are also in high demand, with the company reporting that demand is outstripping supply. This demand is expected to continue growing, especially as its GPUs and chipsets are essential components for gaming, cloud computing, data centers, and AI processing.

This demand will ensure long-term profitability for the company. Moreover, the metaverse and cloud computing are other growth drivers for NVIDIA. As the metaverse becomes a reality, NVIDIA’s GPUs will play a crucial role in enabling virtual reality and augmented reality, and the company’s position in the cloud computing market will likely strengthen.

Conclusion and Summary _ NVIDIA Stock Shock

The recent decline in NVIDIA’s stock may cause anxiety for short-term investors, but from a long-term perspective, this could present a good buying opportunity. The key is to not get caught up in the short-term price fluctuations, but rather focus on the company’s long-term growth potential. Speculative buying with the expectation of quick profits can be risky and lead to significant losses if the market doesn’t behave as anticipated.

On the other hand, value investing with a long-term outlook allows investors to manage risk while positioning themselves for sustained growth. It’s crucial to remain optimistic but also realistic, understanding the risks involved. NVIDIA remains an attractive company as a leader in technology innovation, but as with any investment, caution is always required.

By focusing on the company’s fundamentals and balancing optimism with a realistic approach, investors can better navigate market volatility and make sound investment decisions. Thank you for reading, and we wish you successful investing!

Also Read:

https://www.investopedia.com/terms/e/eps.asp

https://www.stockguidebook.com/10-essential-stock-market-terms-every/